option to tax residential property

Examples of When to Opt to Tax. 2 rows A global option is a single option to tax which covers a large number of properties such as.

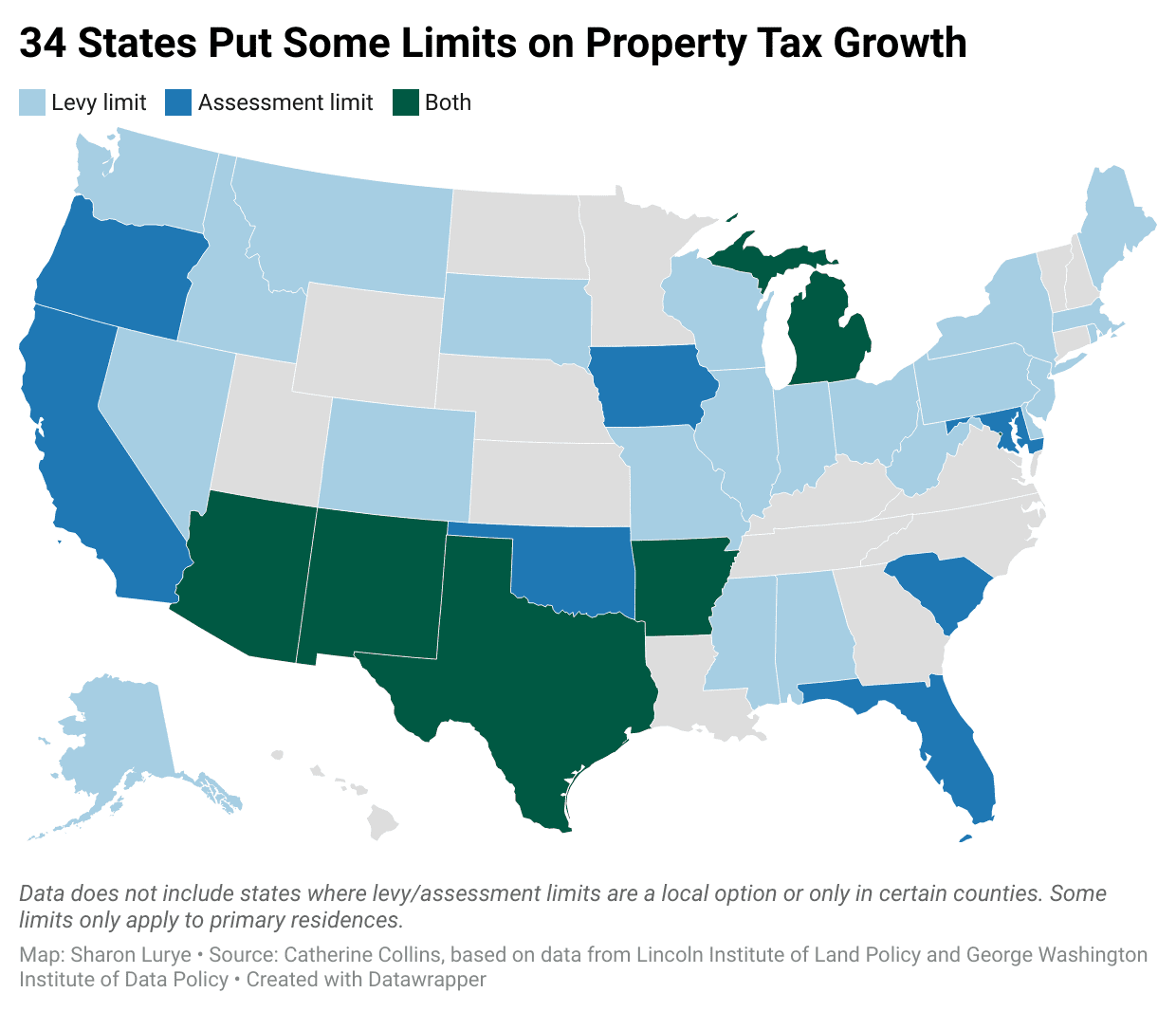

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The property owner must take the decision to opt to tax the property.

. Conveyance of real property or interest in real property Tax Law section 1402-a imposes an additional tax on each conveyance of residential real property or interest in residential real. They have provided a copy of their VAT 1614A form. Then within 30 days they must notify HM Revenue Customs of the decision.

It would mean being able to reclaim all the value added tax. Option to tax lettings. The RETT applies to real estate leases if the following.

However as a landlord you can opt to tax the letting of certain properties. Click on Show once you are prompted to display the property details on the screen and see the details for PCMC property tax online payment. Others are partially exempt such as.

In general New York State Real Estate Transfer Tax RETT is imposed on all real property conveyances at a rate of 04. Option to Tax Explained. Commercial property is exempt unless the property is less than 3 years old or its been opted to tax.

You only need to consider opting to tax if renting property or selling your trading premises in certain circumstances. Fuel cell property limit 500 for each. In some special cases prior permission from HMRC is needed for opt.

Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. You buy a new commercial property. It is and always has been a residential property but for some reason the council has opted to charge VAT on the sale price.

Generally the option to tax will be effective from the date decision to opt is made if HMRC is notified within 90 days. HMRC recommends that the notification. Residential property is exempt unless it is the first supply of a major interest.

The normal position is that the rental of property is exempt from VAT as is the freehold sale of commercial property over three years old. The breweries have been selling off unused properties for several years now and you can often find a decent property in the price range 100000 - 200000 depending on size. Because these are exempt supplies businesses.

The option to tax OTT allows a business to charge VAT on the sale or rental of non-residential property or in other words to make a taxable supply from what otherwise. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. The letting of a property is exempt from Value-Added Tax VAT.

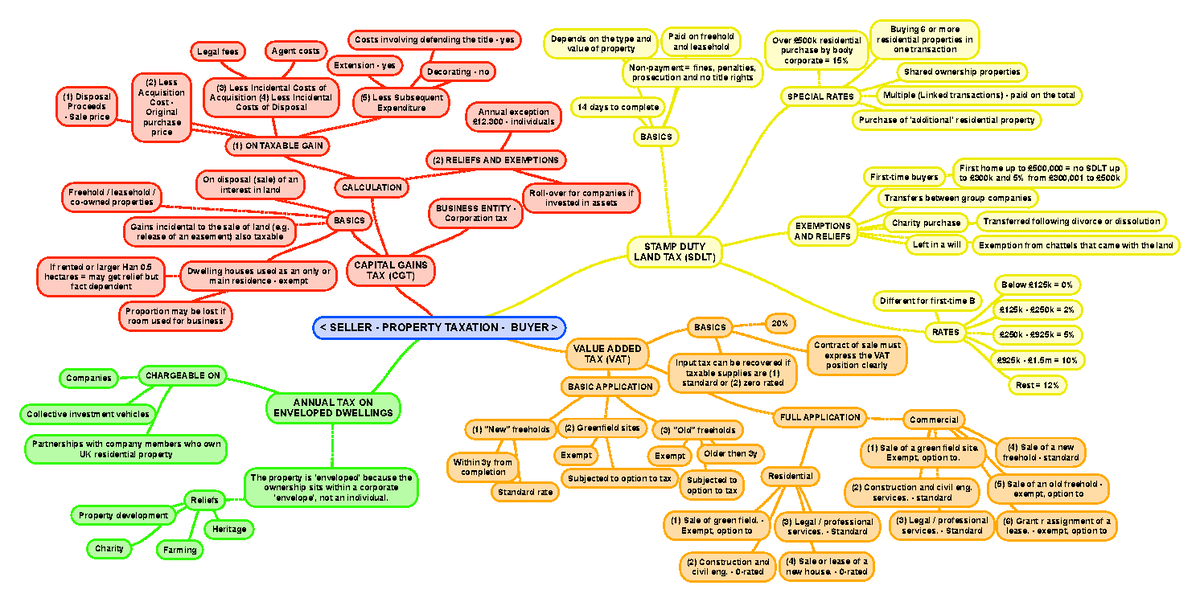

03 Seller Property Taxation Buyer 03 Seller Property Taxation Buyer Lt Seller Studocu

Understanding California S Property Taxes

![]()

Can I Put My Primary Residence In An Llc New Silver

Publication 527 2020 Residential Rental Property Internal Revenue Service

A Tenant S Guide To 421 A The City S Biggest Tax Break For Developers And Landlords The City

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

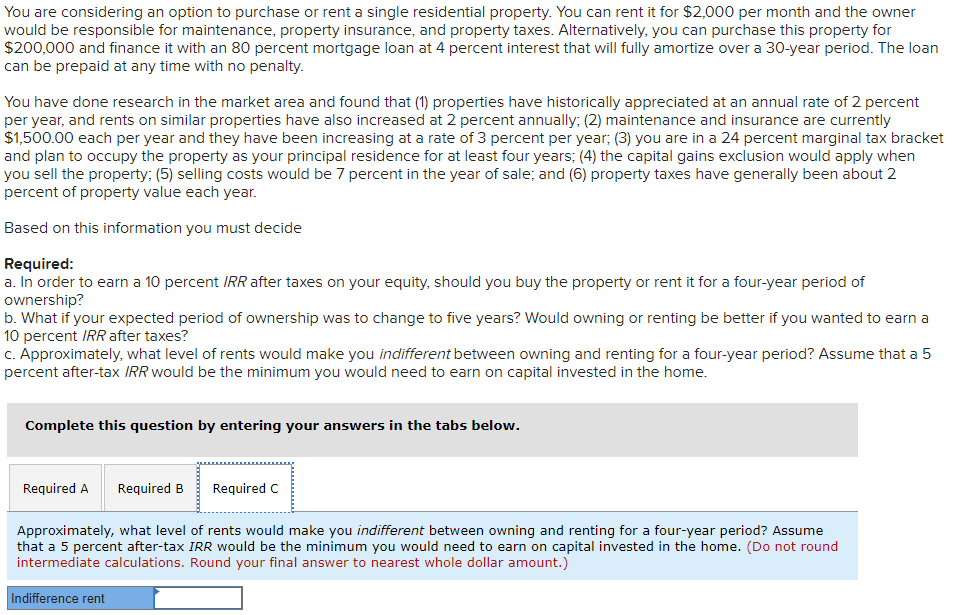

You Are Considering An Option To Purchase Or Rent A Chegg Com

Mytax Dc Gov The Official Blog Of The D C Office Of Tax And Revenue

Property Taxes Are Going Up What Homeowners Can Do About It

:format(webp)/https://www.thestar.com/content/dam/thestar/opinion/contributors/2019/12/09/the-mathematical-truth-about-toronto-property-taxes-raising-them-is-the-best-option/toronto_houses_2.jpg)

The Mathematical Truth About Toronto Property Taxes Raising Them Is The Best Option The Star

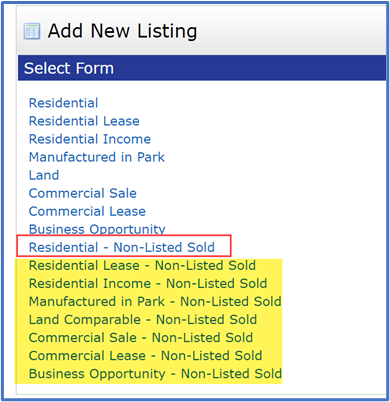

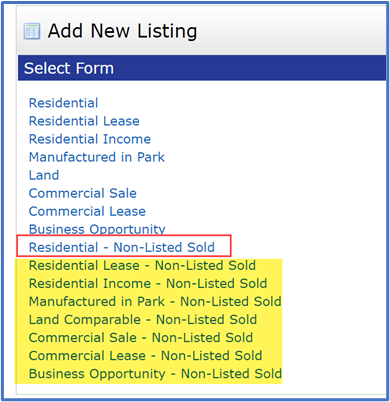

Entering A Non Listed Property As A Comparable Greater Southern Mls

Solved You Are Considering An Option To Purchase Or Rent A Single Residential Property You Can Rent It For 2 000 Per Month And The Owner Would Be Course Hero

I Rent Property In Arizona And Need To Apply The Appropriate Tpt Rates The Auto Tax Function Doesn T Provide A Residential Rental Property Option Any Work Arounds

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)

Investing In Property Tax Liens

Connecticut S Tax System Staff Briefing

Option To Tax What You Need To Know Cowgills

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos